SPEEDY AND ACCURATE DIGITAL ONBOARDING AND FRAUD CHECKS

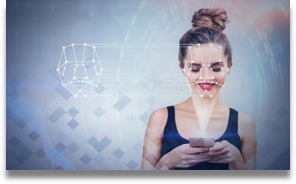

Advanced Facial Recognition

Leading-edge technology for biometric face match, video liveness check, spoofing detection

Fraud Detection

Advanced API services for the widest range of digital identity verifications and fraud checks for superior risk profiling

AI Based Decisioning

Sophisticated technology using AI provides human-like intelligence to check documents, data as well as AML and screening lists

Know your Customer – AI enabled onboarding

Document Proof and Data Extraction

Extracts information from Government and other recognised databases and compares with a customer’s identity to confirm the validity of the ID document

ID Fraud Checks

Checks for document forgery and tampering to ascertain whether an ID card has expired or been tampered with

OCR Checks

The machine learning enabled E-KYC reader precisely reads and extracts national IDs in different formats

Liveness Check

Video forensics allows to check for pre-recorded risk and spoofing to ensure that process captures the identity of the real person

Biometric Face Match

AI powered solution that accurately compares and verifies selfie photos with ID pictures

Interactive UI / UX

Creative, easy to use interface and onboarding walk through provides a convenient verification process and enhances user experience

KNOW YOUR BUSINESS – MAP COMPANY OWNERSHIP AND CONTROL

Business Due Diligence

Undertakes deep, yet quick verification of company information to ascertain credible onboarding information and eliminate inconsistent and potentially fraudulent data

Comprehensive Checks

Extensive, automated checks across a wide variety of databases – ROC, Court cases, negative lists etc.

Regulatory Intelligence

Comprehensive and up to date regulatory risk management ensures compliance with all required KYC mandates across different countries

Automated Background Checks

Algorithms that check over 200 data sources in real time to check, identify and filter for customers and prevent fraud

Customisable workflow

Bespoke checks and processes allows for a creation of a risk profile that fits specific and unique needs of FIs

Modern Dashboard

Allows FI risk managers to view in real time the onboarding status of their customers enabling quick decision making